Florida Real Estate Market: Potential and Opportunities

Imagine a state where the sun shines year-round, the tax policies are as warm as the weather, and the real estate market is constantly buzzing with opportunity. That’s Florida for you—the state where dreams of both luxury living and lucrative investments come true. Whether it’s vacation homes, single-family homes, or commercial properties, Florida caters to a wide range of real estate investors.

It's rapid job growth, low unemployment rate, and robust real estate development truly set Florida apart today. With the fastest-growing GDP in the U.S. and over 140 million annual visitors, the Sunshine State dominates global investors’ wishlists.

⟶ Let’s explore why Florida is a prime destination for property owners and real estate investors.

A Thriving Economy That Fuels Real Estate Growth

Florida isn’t just growing—it’s thriving. The state boasts a low unemployment rate and consistent job growth across major industries, including tech, healthcare, and tourism. These factors provide a stable foundation for real estate appreciation and ensure high demand in the housing market.

In 2023, Florida’s median property price reached $410,000, marking a 5% increase from the previous year and outpacing the national average. This trend underscores Florida’s reputation as one of the best places for real estate investment in the U.S.

Why Florida Properties Stay in High Demand

Best Rental Markets in Florida

Florida’s booming tourism industry and strong job market have made it one of the best rental markets in the country. Vacation rentals near Orlando’s theme parks or Miami Beach generate premium income, while long-term rentals see steady occupancy due to the influx of new residents.

Interesting Fact: Single-family homes in cities like Tampa and Fort Lauderdale remain particularly popular with property owners, often delivering higher rental yields than similar homes in other states.

Competitive Sales Prices and Tax-Friendly Policies

Florida’s competitive sales prices and lack of state income tax attract a growing number of real estate investors. Primary residences may also qualify for property tax exemptions, further boosting affordability.

Where to Invest in Florida for Maximum ROI

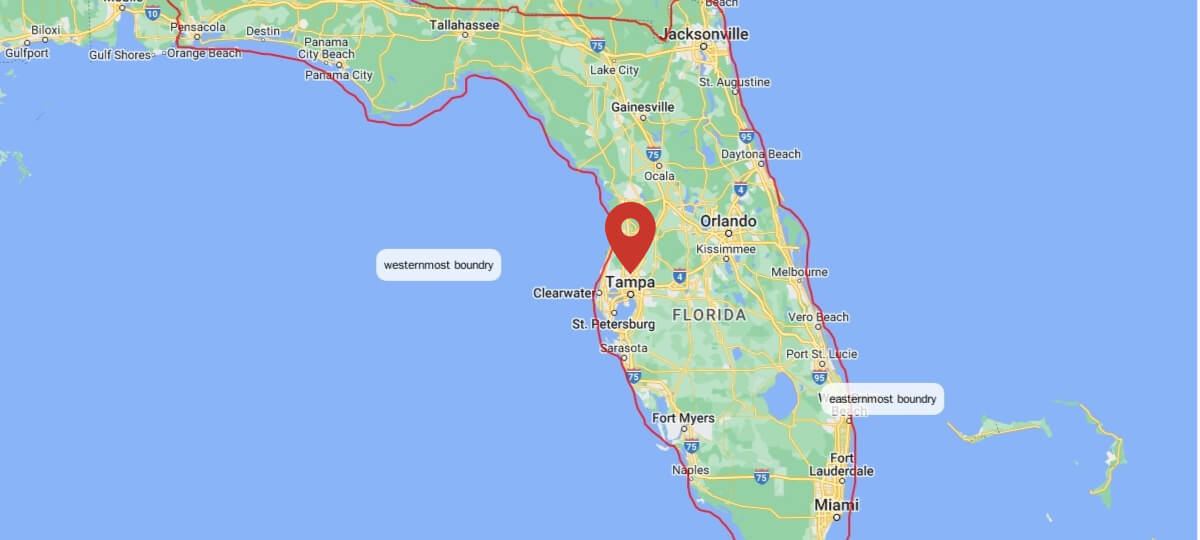

Tampa

The Tampa real estate market is one of the hottest in Florida, driven by job growth and affordable housing prices. Single-family homes in Tampa provide an excellent investment strategy for those seeking steady long-term rental income or future appreciation.

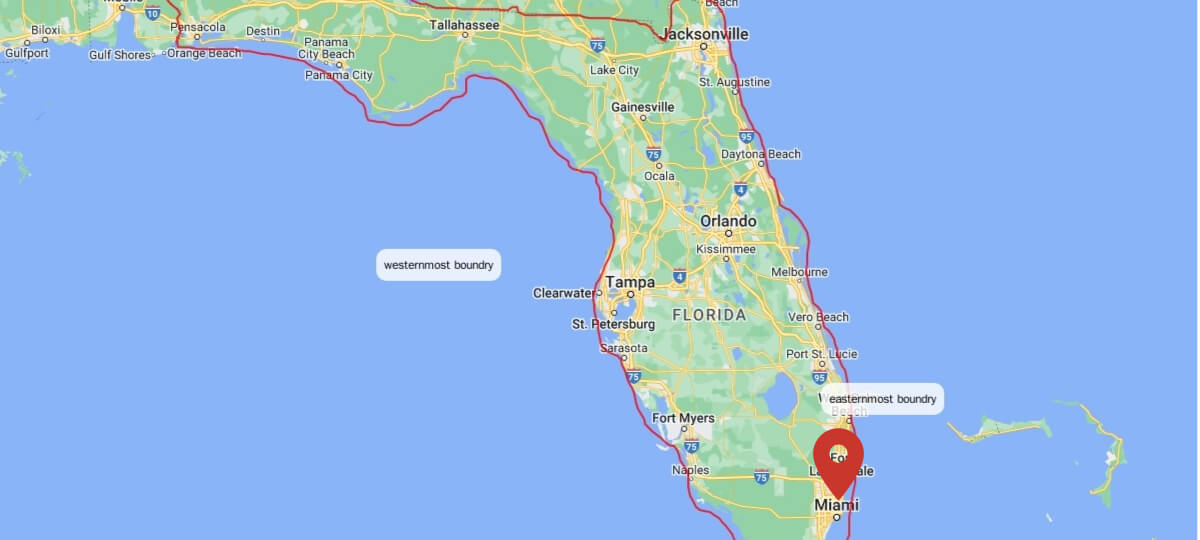

Miami

Miami continues to draw real estate investors from around the globe. Luxury condos, commercial office spaces, and single-family homes are in constant demand, ensuring strong returns in this dynamic real estate industry.

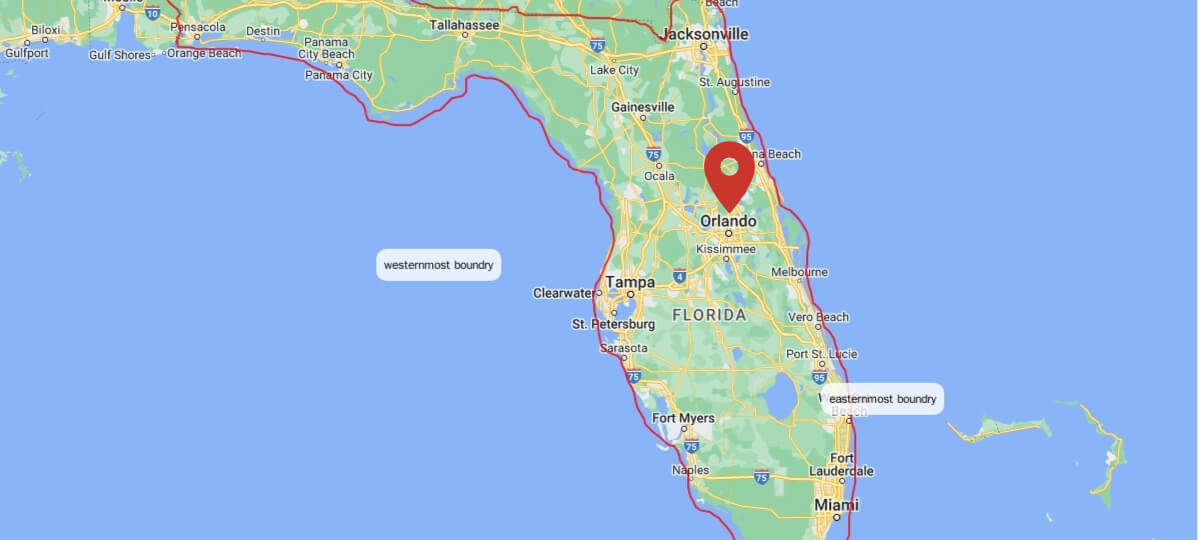

Orlando

Orlando remains a favorite for real estate investing in Florida due to its proximity to world-famous theme parks. Home sales here often outpace other cities as investors recognize the potential of short-term rentals and year-round tourist traffic.

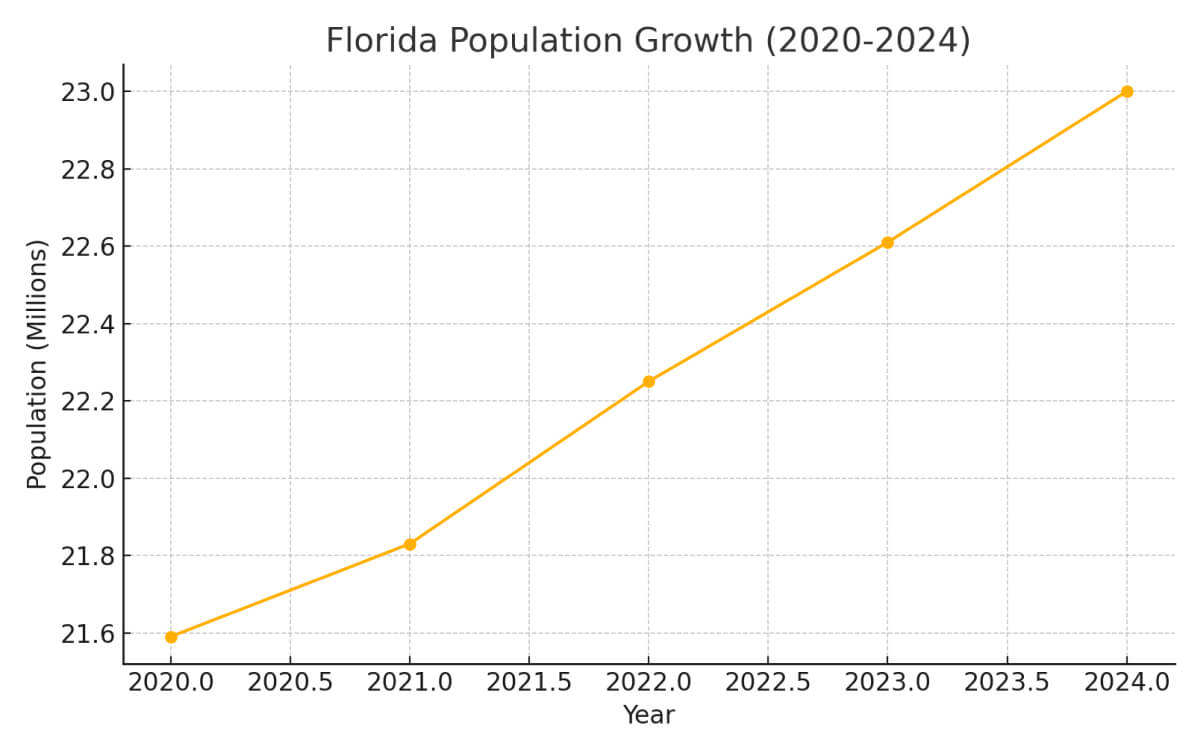

Florida Population Growth (2020–2023)

This graph highlights Florida’s population growth, a key driver of its thriving housing market and increasing home sales.

How Foreign Investors Can Tap Into Florida’s Market

Foreign investors are not restricted from buying property in Florida. However, understanding the local market and navigating its rules is essential.

Must-Have Documents

-

ITIN: Required for tax purposes.

-

Proof of Income: Bank statements and employment verification.

-

FIRPTA Compliance: Ensure compliance with the 10–15% withholding tax when selling property as a foreign owner.

Financing Options for Investment Properties

While many foreign investors prefer cash purchases, financing options through U.S. banks are available. These loans typically require 20–25% down payments, but specialized programs can help offset higher interest rates.

Florida’s Economy and Lifestyle

📌 A Strong Economy and Real Estate Developers’ Paradise

Florida’s job growth and low unemployment rate make it an ideal destination for real estate development. Over 20 Fortune 500 companies call the state home, creating a thriving environment for investment properties and housing prices to rise steadily.

📌 A Lifestyle Few States Can Match

From Miami’s vibrant cultural scene to the tranquil beaches of Fort Lauderdale, Florida offers a lifestyle that blends urban sophistication with coastal charm. Year-round sunshine and strong infrastructure make it a top choice for property owners and renters alike.

Challenges Investors Should Prepare For

Taxes and Compliance

-

FIRPTA: Foreign property owners selling real estate are subject to a 10–15% withholding tax.

-

Property Taxes: Work with a Certified International Property Specialist to navigate these obligations effectively.

Navigating Local Markets

County-specific regulations can complicate transactions. Partnering with a real estate professional who holds a Certified International Property Specialist designation ensures a smoother process.

Why You Should Act Now

The Florida housing market thrives, driven by job growth, low unemployment, and increasing migration. Rising interest rates may deter some buyers, but they create opportunities for savvy real estate investors to negotiate deals and leverage builder incentives.

✓ Pro Tip: For long-term growth, focus on Tampa’s thriving real estate development or Fort Lauderdale’s single-family homes. Orlando remains one of the best rental markets in Florida for short-term rental income.

Frequently Asked Questions

1. Where are the best places to invest in real estate in Florida?

Tampa, Miami, and Orlando are top picks, offering a mix of affordability, high demand, and long-term appreciation.

2. What makes Florida’s real estate market unique?

Florida’s competitive sales prices, no state income tax, and high rental yields make it a great place for real estate investment.

3. Are there financing options for foreign investors?

Yes, foreign buyers can access U.S. bank loans, typically requiring 20–25% down payments.

4. What are the challenges of investing in Florida real estate?

Understanding FIRPTA regulations, navigating local markets, and managing property taxes can be challenging. A Certified International Property Specialist can help simplify the process.

5. Why is Florida one of the best rental markets in the U.S.?

The combination of high demand, job growth, and steady migration makes Florida ideal for both short-term and long-term rental investments.

Take the Next Step Toward Your Florida Investment

Florida’s real estate market isn’t just another opportunity—it’s one of the most dynamic and profitable in the U.S. Whether you’re targeting single-family homes, short-term rentals, or long-term investments, the Sunshine State delivers unmatched potential for real estate investors.

Let Wealth Consulting guide you every step of the way. Schedule your consultation today and start building your future in one of the hottest real estate markets in the U.S.

Contents

- A Thriving Economy That Fuels Real Estate Growth

- Why Florida Properties Stay in High Demand

- Where to Invest in Florida for Maximum ROI

- How Foreign Investors Can Tap Into Florida’s Market

- Florida’s Economy and Lifestyle

- Challenges Investors Should Prepare For

- Why You Should Act Now

- Frequently Asked Questions

- Take the Next Step Toward Your Florida Investment