Off-plan vs. Ready Properties in UAE: Which to Choose?

You've got the means, the willingness to take risks, and a plan to invest in the UAE's booming real estate market. You can already envision the bright future ahead—whether it's owning a luxurious villa, a modern apartment, or a prime commercial space. Maybe you already own several properties and are pondering your next move. Or perhaps this is your first time investing in Dubai, and you want to make the best choice. Each country has its own rules and nuances, and the UAE is no different. We're here to provide trustworthy information so you can confidently decide what suits your needs best.

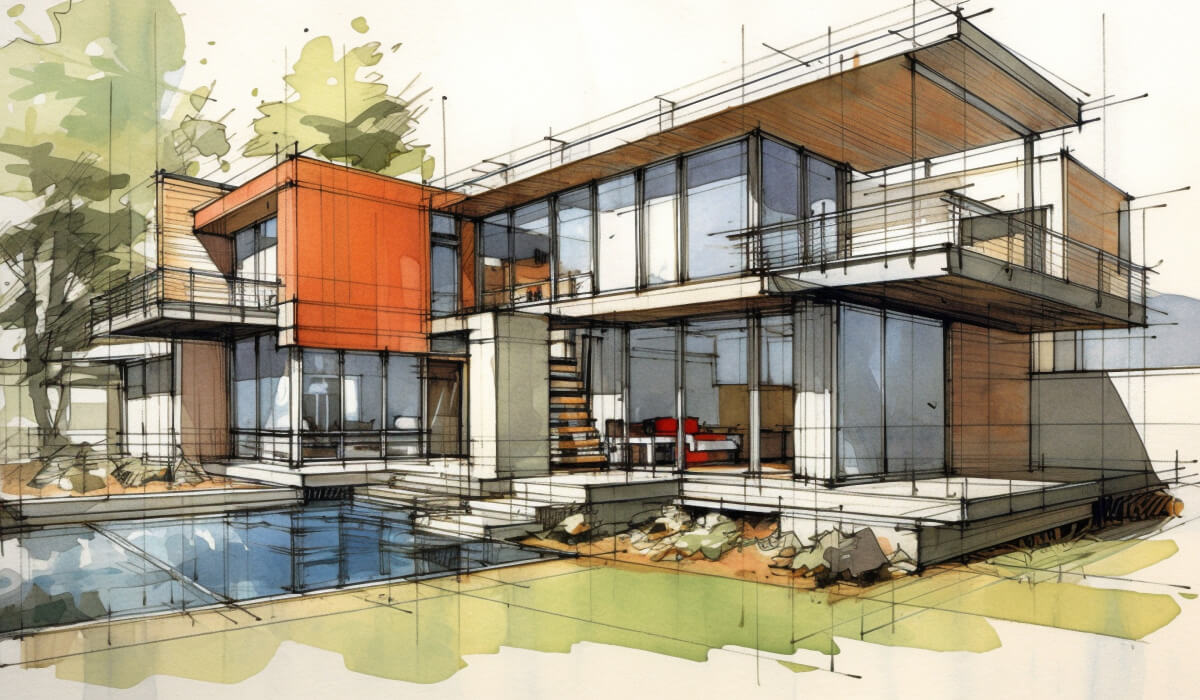

When you’re looking to buy property in Dubai, you’ll come across off-plan and ready-to-buy properties. So, what decision should you take? In this blog, we’ll explore the pros and cons of off-plan and ready-to-buy properties to help you make an informed decision.

First, let’s examine the trends and statistics from the Dubai Land Department (DLD) regarding the buying and selling of off-plan and ready-to-buy properties.

Trends and Statistics from the Dubai Land Department (DLD)

Trends are fast-changing and hard to predict without professional market understanding. When deciding between off-plan and ready properties, Dubai Land Department (DLD) trends and statistics should be on your desk. The DLD's data reflect the market's health and core investor preferences, so it is valuable data on the buying and selling off-plan and ready-to-buy properties.

· Off-Plan Property Trends

Recent data from the DLD shows a significant interest in off-plan properties, driven by attractive payment plans and the promise of high returns. From the current off-plan sales dynamic, you can guess that investors prefer to purchase new project launches. This trend strongly indicates their confidence in Dubai's real estate market. It also says a lot about the rise of developers' promotional efforts and the quality of new properties.

· Ready Property Trends

Ready properties are generally more expensive than off-plan choices, but they remain a steady choice for buyers seeking immediate occupancy. The DLD data indicates that ready properties attract buyers looking for stability and reduced risk. This is a logical trend, considering the sense of security and assurance one can get when purchasing a property after fully examining it.

The Pros of Buying Off-Plan Properties

Cost Savings and Appreciation

Cost Savings and Appreciation

One of the best advantages of buying an off-plan property is the ability to save costs and benefit from appreciation of the property’s value in the future. Since these properties only exist on paper, investors typically pay less than they would for a ready property. The developers also make great marketing efforts to position value appreciation and gain more sales. Thus, you get more options in the market.

Flexible Payment Plans

Flexible Payment Plans

Developers provide flexible payment plans to simplify investment. They allow buyers to pay via yearly plans divided into monthly installments. This makes payments more manageable, as investors do not have to pay much money all at once. In case you have a bank account in the UAE, the process will be more streamlined and easy.

Modern Facilities

Modern Facilities

Off-plan properties are recently developed projects. They are fresh, never utilized, and built based on the latest standards. You can also watch the process. They mostly provide great accommodation facilities such as temperature-controlled swimming pools, hi-tech gyms, landscaped gardens, and community centers. These features are often more advanced compared to ready properties.

Secure Investments

Secure Investments

Dubai recently introduced escrow accounts. In an escrow account, the buyer’s investment is protected by a third party, known as an escrow agent. This ensures that developers keep the deadlines and the buyer’s investment remains secure.

Another option would be to have a trusted local partner who will have first-hand networks and can guide you through the processes so you don't face unexpected problems.

The Cons of Buying Off-Plan Properties

Construction Delays

Construction Delays

One of the biggest risks in buying off-plan properties is the potential for construction delays due to changes in legal regulations, raw material prices, or disputes. These delays can prolong the project's completion, cause uncertainty among investors, and even lead to a failed investment.

Limited Information About the Finished Product

Limited Information About the Finished Product

Another drawback is the risk of being unable to visualize the finished product. Unlike ready properties, off-plan properties cannot be inspected until construction progresses. So, if you want to be more secure and know exactly what you are paying for, your choice may be ready properties.

The Pros of Buying Ready Properties

Immediate Availability

Immediate Availability

A major advantage of buying ready properties is immediate availability. You can occupy the property as soon as you close the deal. This is a great choice if you plan to relocate there or start generating rental income immediately.

Ability to Evaluate the Finished Product

Ability to Evaluate the Finished Product

Ready properties allow you to evaluate the current product, giving you a clear idea about the quality of the exterior and the materials used. This ensures that you can make an informed decision and avoid future hassles.

Opportunities for Negotiation

Opportunities for Negotiation

Ready properties are often second-hand properties sold by their existing owners. Thus, you can easily negotiate and secure better deals than off-plan properties.

The Cons of Buying Ready Properties

Limited Options for Customization

Limited Options for Customization

Ready properties are harder to adapt to your personal preferences. There is limited room for customization, and any changes might require starting from scratch, adding to the cost.

Dealing with Existing Wear and Tear

Dealing with Existing Wear and Tear

Again, these properties are previously owned, so be amazed if you see imperfections and signs of use. Be prepared for possible repairs or renovations to address outdated features, structural problems, or cosmetic wear and tear.

Obsolete Systems and Appliances

Obsolete Systems and Appliances

Older properties often have systems and appliances that need repair or replacement. Of course, these expenses are not included in the purchase costs.

Making the Right Choice for You

Let's break down the key factors we mentioned above to have the general picture:

![]()

Budget

· Ready Property:

Generally more expensive due to the convenience of immediate availability. Ideal for those ready to invest more for instant access and less hassle.

· Off-Plan Property:

Often more affordable, with attractive payment plans and the potential for future appreciation. Suitable for investors looking to maximize their budget and benefit from capital growth.

![]()

Timeline

· Ready Property:

This option is perfect if you need a property now. It offers immediate possession with no waiting time, making it excellent for those needing to relocate or generate rental income immediately.

· Off-Plan Property:

This type of property is suitable for those with the luxury of time and can wait for construction to complete. The wait can be worth it if you aim for customization and potential market value increases.

![]()

Personal Preferences

· Ready Property:

This allows you to see the actual property before deciding. This is great if you want to know what you’re buying.

· Off-Plan Property:

This option allows you to customize the property according to your preferences. It is ideal if you envision your perfect space and want it tailored to your taste.

Building Your Investment Strategy in the UAE

Ultimately, the choice between ready and off-plan properties should align with your specific circumstances and investment goals.

Ready properties provide the convenience of immediate occupancy and the security of inspecting the final product before purchase. On the other hand, off-plan properties offer customization options and the potential for higher returns, though with higher associated risks.

When deciding, consider your financial situation, timeline, and long-term objectives carefully. Whether you choose a ready property or decide to invest in an off-plan project, the UAE’s dynamic property market offers many opportunities for growth and success. By aligning your property choice with your broader investment strategy, you can make a well-informed decision that supports your aspirations and enhances your portfolio.

Why Trust Us?

Wealth Consulting leverages our extensive local experience, long-term connections, and deep expertise to guide you through the UAE property market. Whether buying your first property or adding to a growing portfolio, our trusted network and market insights will ensure you make informed decisions.

For any inquiries or further information, feel free to reach out to the Wealth Consulting team:

Book a Call with our experts to discuss your financial needs and explore personalized solutions.

Contents