Saudi Vision 2030: Real-Estate Investment & Growth in Saudi Arabia

The luxury real estate market in Saudi Arabia is quickly emerging as a top destination for global investors. The Middle East, in general, has a very high bar in comfort and living standards, and Saudi Arabia goes even further.

When the country opened its doors with Vision 2030, it was a bold move backed by over $1.3 trillion in real estate and infrastructure projects—capturing more than 60% of the region’s total value. They create a whole lifestyle, building luxury retreats, and offer real estate options for any taste.

But what makes Saudi Arabia’s real estate market so appealing for investors?

Let’s get into the factors behind this growth, the prime locations to consider, and the potential risks.

Vision 2030: A Catalyst for Real Estate Growth

➞ Vision 2030 has placed real estate at the forefront of Saudi Arabia’s economic transformation, with cities like Riyadh and Jeddah becoming dynamic hubs of real estate development. Billions are channeled into residential, commercial, and tourism-focused projects reflecting a modern, sustainable future.

➞ Vision 2030’s emphasis on smart cities and eco-friendly designs—through mega-projects like NEOM and the Red Sea Project—draws attention from foreign investors and property owners who value sustainability and innovation.

The government’s eyes and high commitment to these projects give real estate in Saudi Arabia an additional layer of stability. And this enhances its appeal to property owners seeking secure and long-term growth.

Projected Growth of Saudi Arabia's Real Estate Market through 2030

To illustrate this growth, here’s a projection of real estate investment value in Saudi Arabia through 2030:

The chart above underscores how the government’s investments are setting the stage for consistent growth, attracting attention from property owners and foreign investors who see Saudi Arabia’s real estate as a long-term, high-value asset.

The Role of the Real Estate General Authority

The Real Estate General Authority is considered one of the most important drivers for change in Saudi Arabia's real estate market. Under the banner of Vision 2030, it works to provide stability and complete transparency to all parties. With clear rules and quality standards, this Authority will help local and international investors make decisions. They will use real and reliable data.

Government-Backed Projects: A Stable Investment Choice

For global investors, the safest bets lie within the government-backed projects under Vision 2030. Developments such as NEOM and the Red Sea Project aren’t only ambitious; they’re part of a larger commitment to modern infrastructure and sustainable growth. These projects offer a stable environment for real estate investment in Saudi Arabia, providing both the benefits of investing in real estate and the security of government support.

Prime Investment Areas: Key Metrics by Region

For investors seeking to understand the landscape, some locations stand out for their growth potential and rental yield. Below is a table highlighting the prime regions in Saudi Arabia, along with essential metrics such as average rental yield, capital appreciation, and average property price:

|

Region

|

Average Rental Yield (%) |

Capital Appreciation (%) |

Average Property (USD) |

|

Riyadh |

5.5 |

8.0 |

1,000,000 |

|

Jeddah |

5.0 |

7.5 |

950,000 |

|

NEOM |

6.2 |

10.0 |

1,500,000 |

|

Red Sea |

5.8 |

9.0 |

1,200,000 |

|

King Abdullah Financial District |

6.0 |

8.5 |

1,300,000 |

This table showcases the diversity of real estate opportunities across Saudi Arabia’s urban centers and major projects. The data reflects regions that promise high return on investment for investors, especially those focused on both capital growth and rental income.

Riyadh and Jeddah: Prime Locations for Luxury Real Estate

Riyadh and Jeddah are central pillars in Saudi Arabia’s luxury real estate market. Areas like Riyadh’s King Abdullah Financial District and Jeddah’s Corniche offer high-end properties with prime locations and substantial rental yields.

These cities attract expats and the local elite, creating a consistent demand for luxury housing. For those who consider buying property in Saudi Arabia, these locations are stable, high-growth areas that offer impressive returns.

For investors seeking real estate opportunities in these vibrant cities, both Riyadh and Jeddah are destinations worth considering. They offer access to a dynamic urban environment, premium amenities, and high rental demand, making them ideal for diversifying their Saudi real estate market portfolio.

The Red Sea Project As An Eco-Luxury Phenomen

The Red Sea Project is a landmark eco-tourism development on Saudi Arabia’s west coast. The area is around 28,000 square kilometers, featuring 50 luxury hotels, private residences, and high-end amenities, positioning itself as a sustainable luxury destination. This project allows investors to tap into a high-end, eco-friendly property market attracting global attention.

For those looking to invest in buy-to-let properties or exclusive holiday homes, the Red Sea Project’s focus on sustainable luxury offers strong potential for return on investment and long-term capital growth.

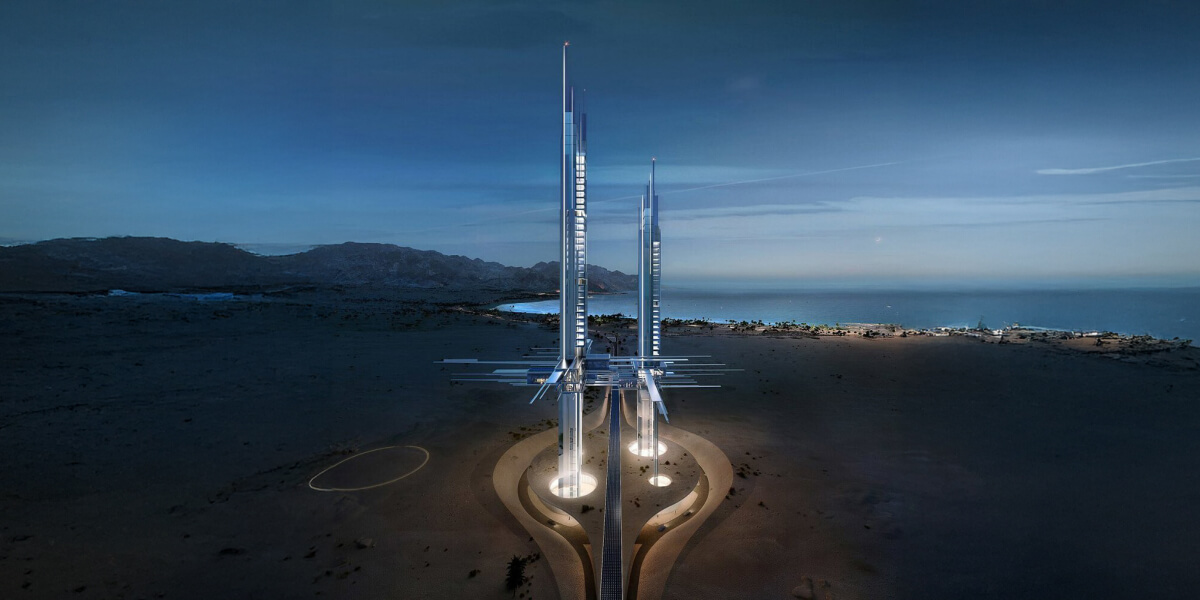

NEOM: A Futuristic Vision of Luxury Living

NEOM, a $500 billion mega-city, is one of the most ambitious projects worldwide. Entirely powered by renewable energy, NEOM is designed as a hub of advanced technology, smart infrastructure, and sustainable luxury. For investors, NEOM is a unique opportunity to experience significant capital appreciation as the project develops into a world-class destination.

Investing in NEOM aligns with the advantages of real estate investment in emerging sustainable cities, offering investors a stake in the future of urban living. With a projected completion date of 2030, NEOM represents a long-term commitment to innovation and growth, making it a solid choice for patient investors.

Risks: Oversupply and Market Volatility

While the potential is immense, there are risks to consider. The influx of luxury projects may lead to an oversupply in the market, which could impact property prices in Saudi Arabia and affect both rental yields and capital appreciation. Additionally, while Vision 2030 is diversifying the economy, Saudi Arabia still has some reliance on oil. A downturn in global oil prices could impact funding for these mega-projects, affecting the local market.

Rising interest rates are another factor, potentially impacting demand in the luxury sector as borrowing costs increase. Investors must stay informed and consider these risks when assessing real estate business opportunities in the Kingdom.

Diversifying and Taking a Long-Term Approach

A diversified and long-term approach is crucial for those interested in real estate investment in Saudi Arabia. Spreading investments across different regions and types of properties can mitigate potential risks. Using a long-term strategy helps investors handle early ups and downs. This approach allows for steady growth in a market that is still developing and stabilizing.

Legal Reforms: Increased Confidence for Foreign Investors

One of the most encouraging changes for foreign investors is the introduction of new legal reforms in Saudi Arabia. Certain areas, such as Riyadh’s Diplomatic Quarter and the Red Sea Project, now allow foreigners to own property outright. These regulatory changes enhance transparency and accessibility for international investors, reducing barriers to entry and boosting confidence in real estate ownership within the Kingdom.

Strong Potential for Global Investors

Saudi Arabia’s luxury real estate market provides a unique opportunity for investors to enter one of the world’s most dynamic property sectors. Backed by Vision 2030 and supported by extensive government initiatives, the market offers the advantages of investing in real estate, including high rental yields and strong capital growth.

To understand more about Saudi Arabia’s residency options, explore our page on Saudi Arabia's Premium Residency Program.

While challenges such as market saturation and economic reliance on oil remain, the government’s dedication to mega-projects like NEOM and the Red Sea Project offers a rare level of stability in emerging markets. Saudi Arabia’s real estate market provides great opportunities for investors. They should focus on key urban areas and government-backed projects.

Book a call to create a clear, professional path to investments.